Payables Solutions

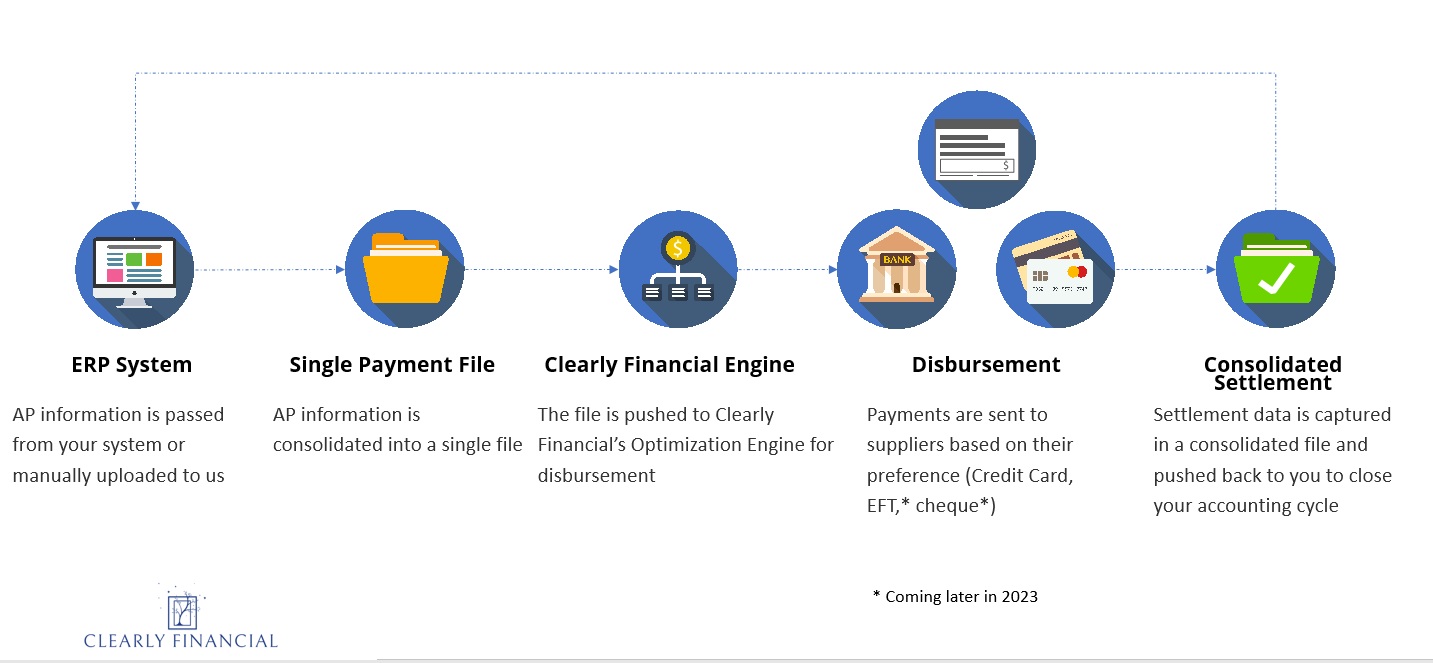

Accounts Payable (AP) Automation

We've witnessed seismic changes in payments in the last two decades: Online commerce, cards becoming the new standard, Apple & Google Pay, contactless payments from your device. And while the shift away from cash/checks is almost complete in the consumer world, B2B still has a ways to go.

With complex supply chains, shifting payment terms, tightened credit, and inflation impacting your cost of capital - you need to focus your effort to optimize results.

This is where we come in. I built Clearly Financial to help more businesses profit from the secrets I learned in my career working with Enterprise-sized clients.

We help you make smarter, more profitable choices.

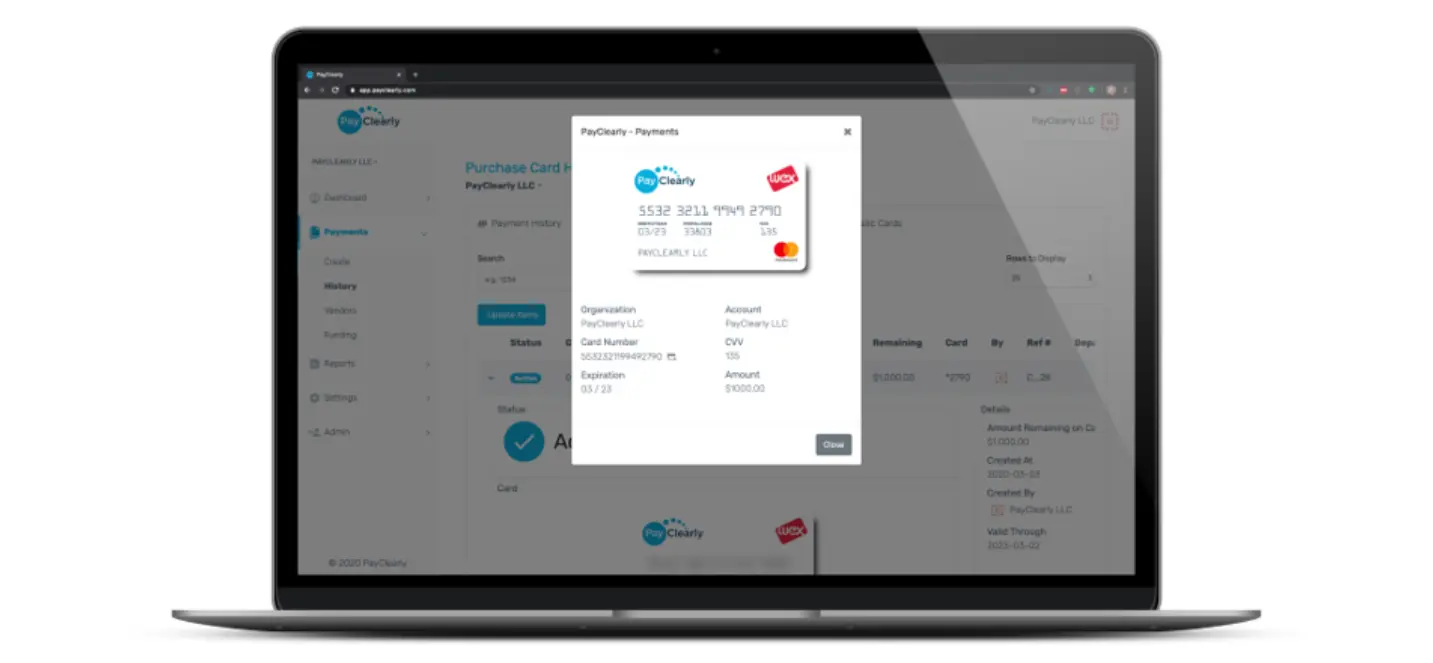

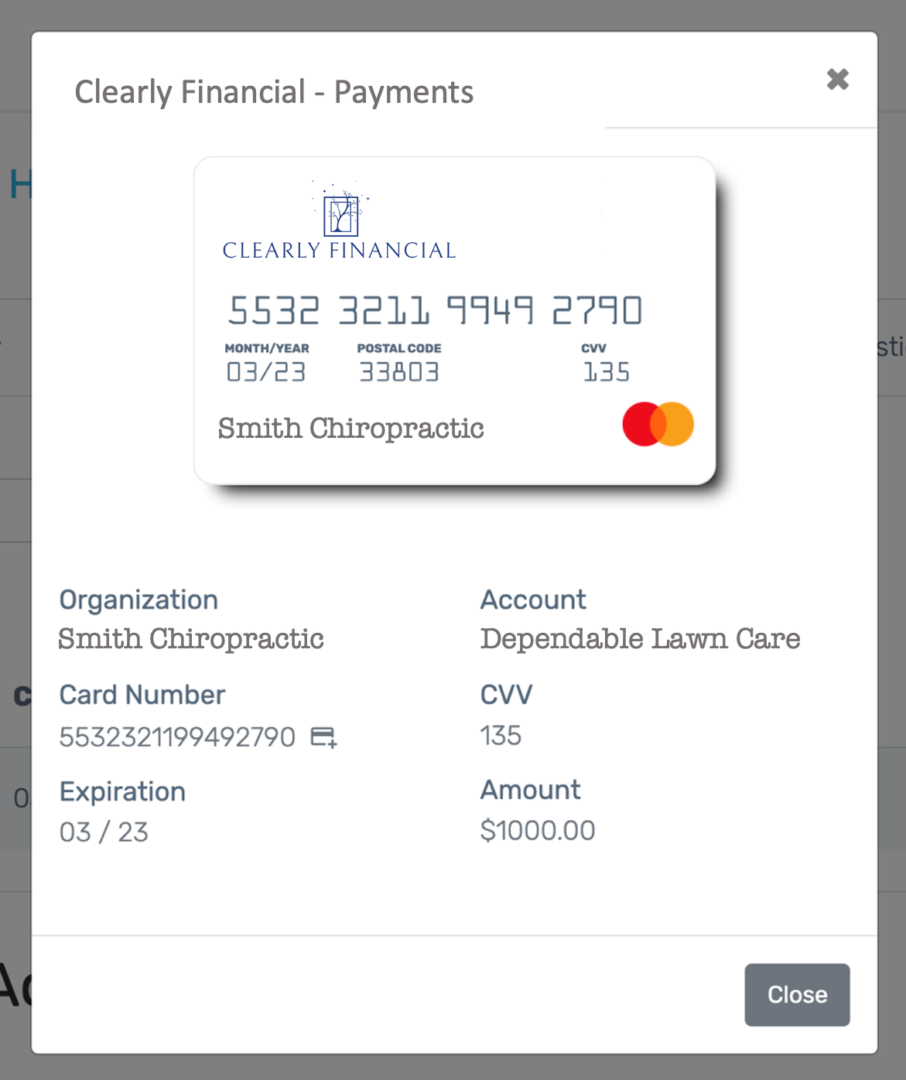

And we will show you how to use your existing tools to harness the power of Virtual Cards to maximize the financial benefit to your business.

With more demands on your time and fewer resources to assist, it can be a challenge to navigate this journey alone.

Let us help.

Clearly Financial can help in a number of ways:

-

choosing a virtual card provider

- implementing a new program

-

choosing a virtual card provider

- showing you how to run it

-

expanding virtual card usage to replace: store cards, travel cards, ACH/EFT, check/cheque, petty cash, vouchers, or wires

-

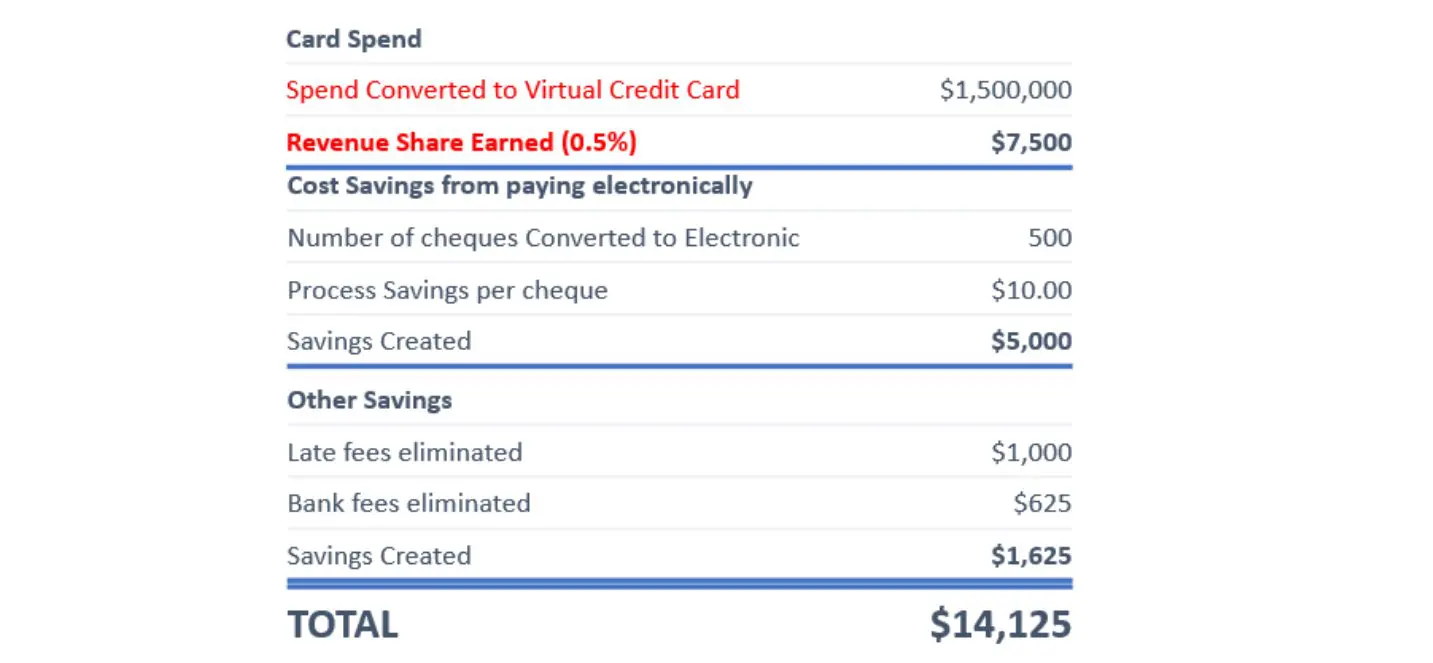

consolidating your spend to drive increased discounts and rebates

-

showing you the ROI from your investment.

If you don't have a program, let us help you choose one...If you do, let us help you make it more rewarding!

Control is at your fingertips.

Why Suppliers Accept Card

It’s simple, because it benefits them too!

Clearly Financial card-based payments save your suppliers’ both time and money by streamlining their collections and reporting. Essentially we can pay them even faster while providing secured, guaranteed payments that provide better visibility and reporting.