What We Do

Payable & Receivable Solutions

Coming from the world of Treasury solutions I learned how larger clients of the Banks and Networks had configured their tools and processes to optimize their incoming and outgoing payment functions.

The strategy is relatively simple automate where you can, drive KPIs that impact the stock price, lock down controls where you have to, but leave the system flexible enough to require minimal human intervention.

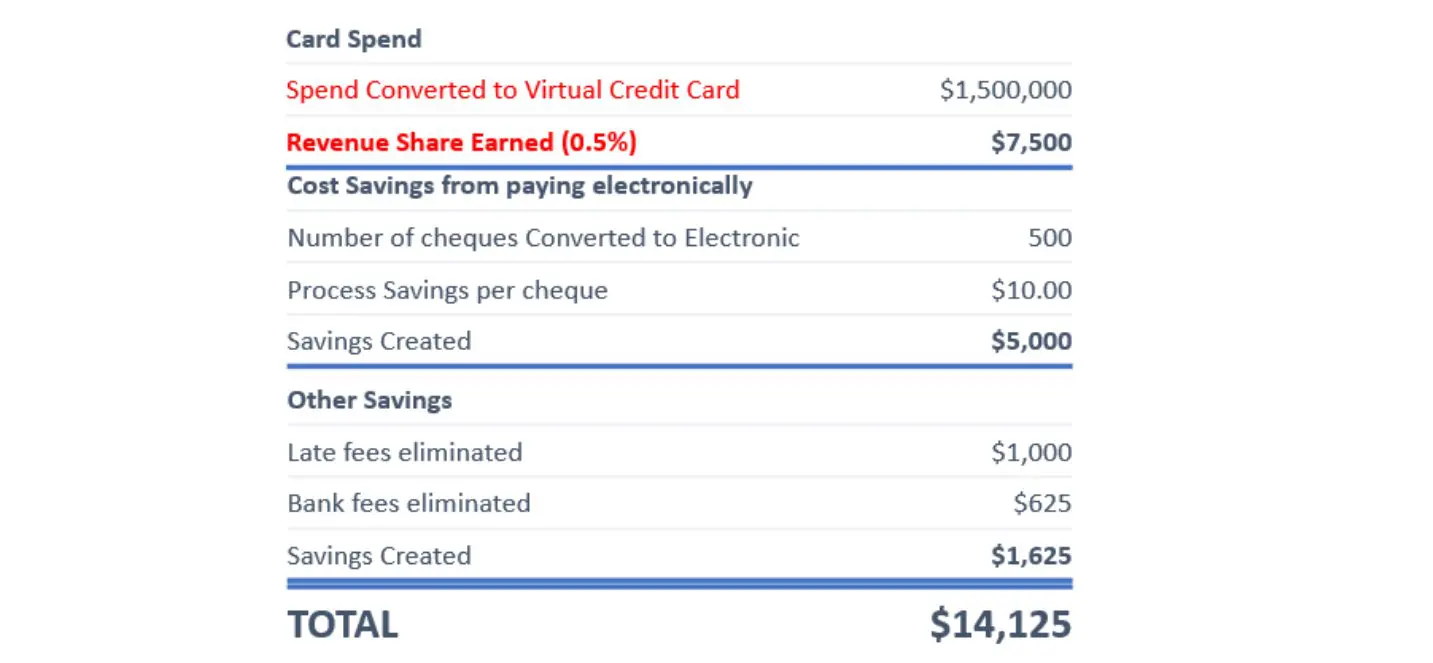

The way economic forces drive results means that every hard and soft dollar saved in terms of efficiency contributes to an increase in value of the company.

Until now there has been the same degree of professional tools available to the entrepreneurial class of business.

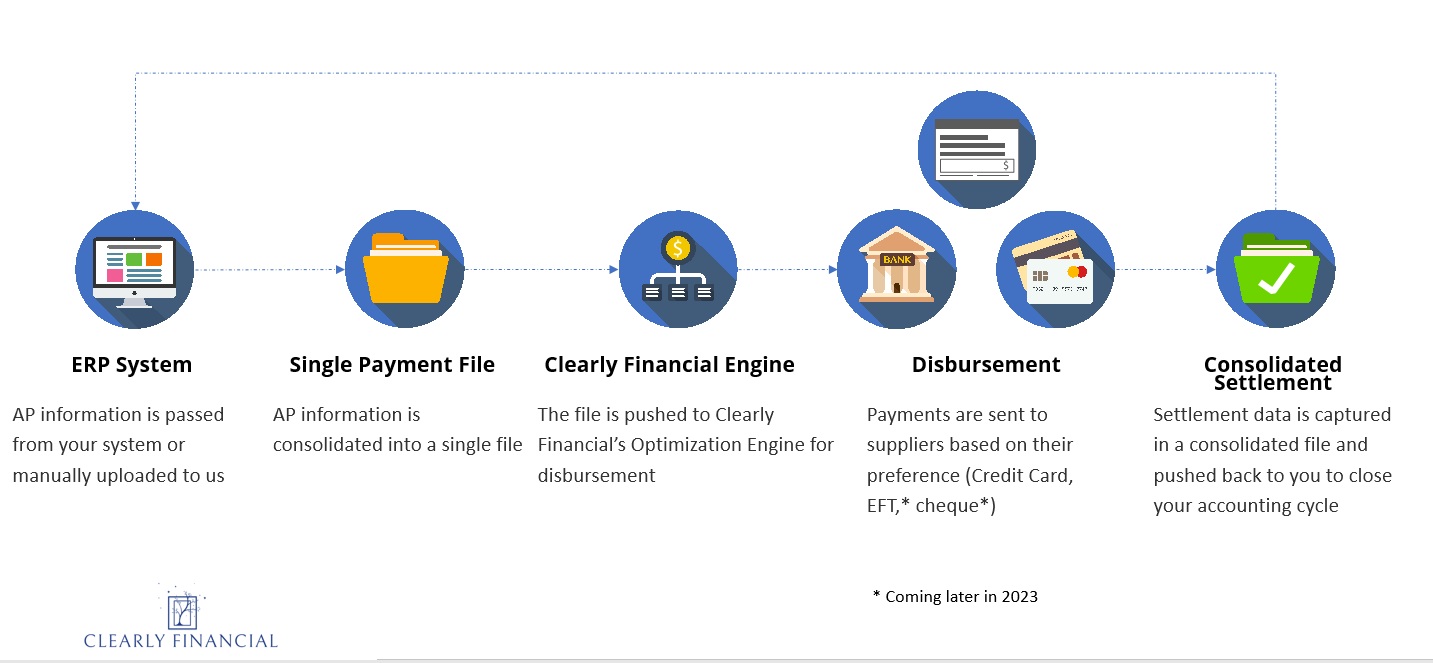

This is where Clearly Financial comes in. I built Clearly Financial to help businesses take advantage of these new tools. I sought out and partnered with companies I knew make a difference every day. Our tools and our partners give you the choice that you have never had before with world-class products and services delivered through Clearly Financial.

We act as your strategic thinker, professional adviser, product expert, and hands-on customer support to help your business benefit from all the changes happening in the market today.

Let us help.

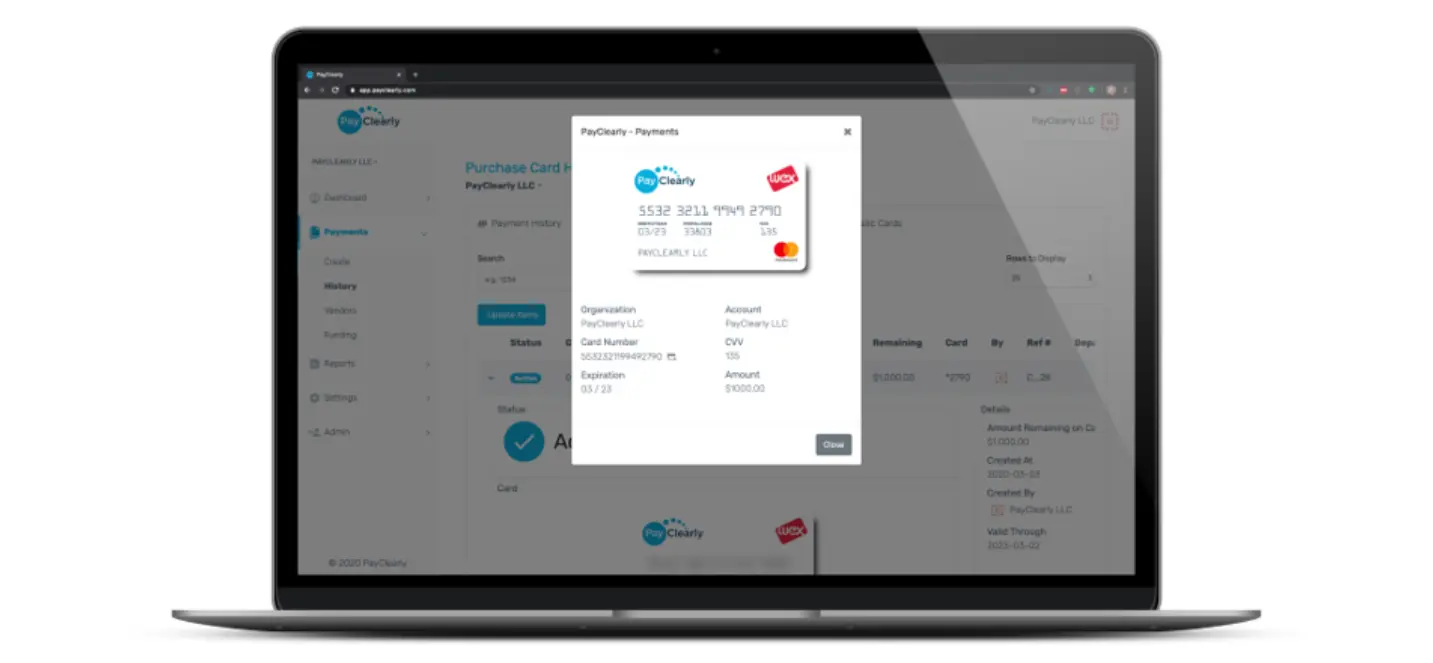

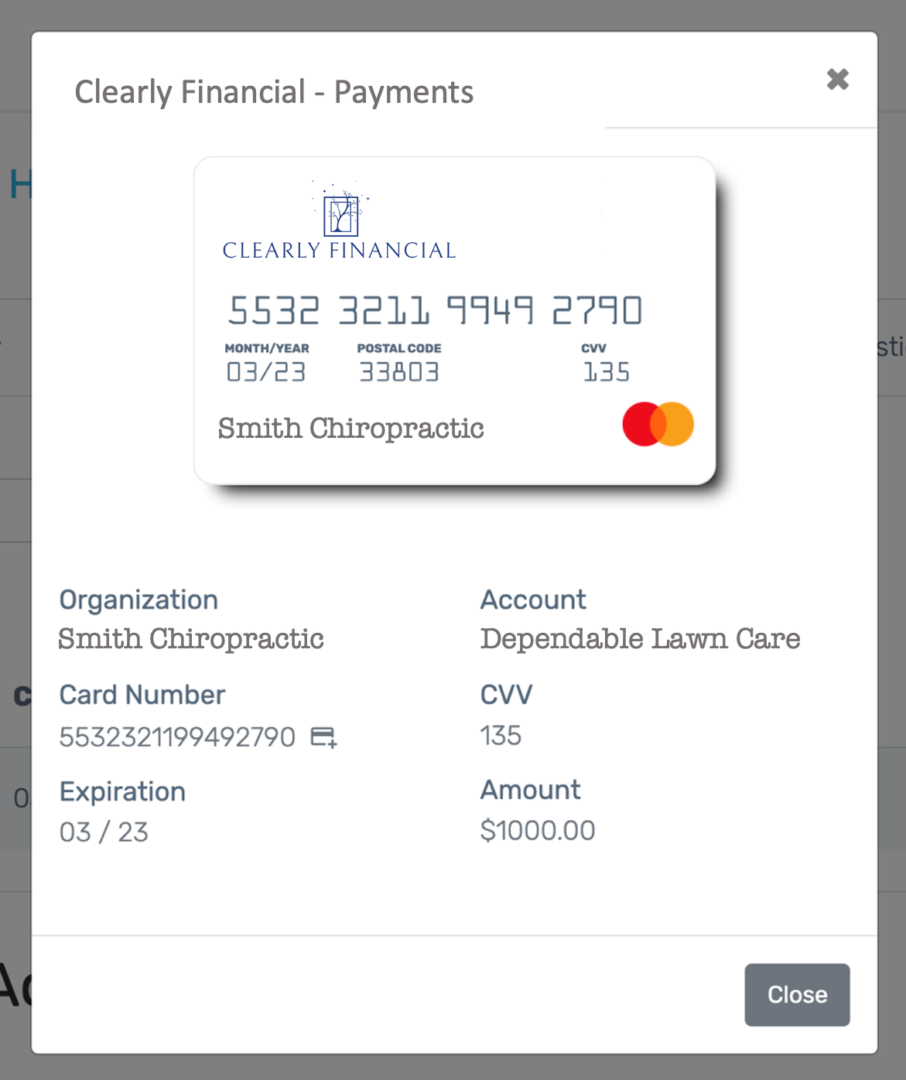

Control is at your fingertips.

Why Suppliers Accept Card

It’s simple, because it benefits them too!

Clearly Financial card-based payments save your suppliers’ both time and money by streamlining their collections and reporting. Essentially we can pay them even faster while providing secured, guaranteed payments that provide better visibility and reporting.